Executive Signal Summary

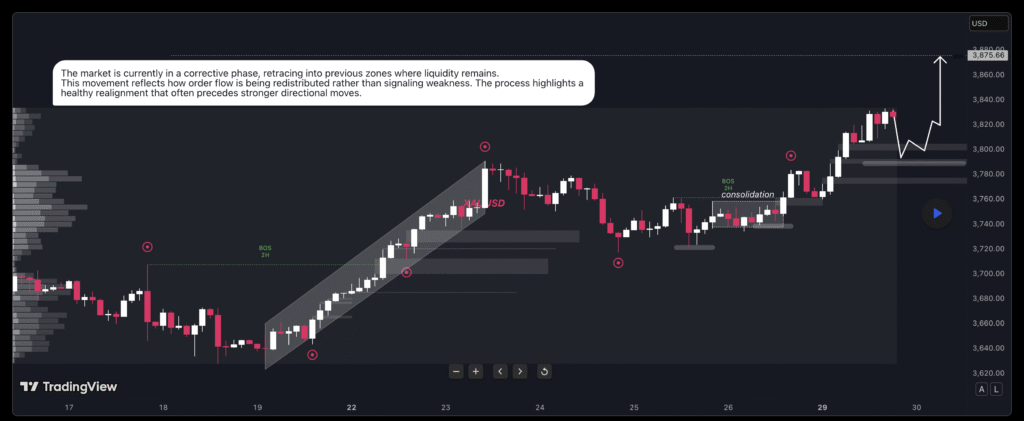

The XAU/USD pair is currently positioned within a high-conviction structural uptrend, trading at all-time highs (ATH) above $3,800. While the overall bias is Strongly Bullish, technical indicators are stretched (overbought).1 Therefore, the optimal daily strategy avoids market buying at the peak and focuses on executing a

Buy Limit order at confirmed structural support to achieve a superior risk-to-reward entry.

The signal below is valid for intra-day trading on Tuesday, September 30, 2025, and is structured to capitalize on profit-taking retracements toward the validated breakout level.

| Action | Entry (Optimal Buy Limit) | Take Profit (TP) | Stop Loss (SL) | Risk/Reward Ratio |

| Buy Limit | $3,792 | $3,842 | $3,774 | Approx. 2.78:1 |

Primary Trend: Strongly Bullish 3

Near-Term Target: $3,900 1

Structural Invalidation: Sustained daily close below $3,700 1

Rationale: Why This Specific Signal?

The choice of a Buy Limit at $3,792 is not accidental; it is based on the synthesis of risk management principles and validated technical structure:

- Risk Mitigation of Overbought Extremes: Gold is trading in unchartered territory, and momentum indicators are “extremely stretched” across multiple timeframes.1 Attempting a market entry near $3,830 carries immediate risk of a sharp technical correction due to profit-taking.4 The limit order manages this risk by requiring price to pull back, securing a safer entry point.5

- Leveraging Structural Support: The entry point at $3,792 is precisely calibrated around the Immediate Support (S1) level of $3,790.3 This level previously functioned as a crucial breakout resistance. A fundamental technical law dictates that former resistance, once decisively broken, often flips to become robust support—the “first line of defense” for buyers.4 Executing the Buy Limit here confirms that the market is respecting this new floor before continuing its ascent.

- Optimal Asymmetrical Risk Profile: The Stop Loss (SL) is set at $3,774, just below the secondary support cluster at $3,783.3 This tight placement minimizes capital exposure if the price fails to hold the $3,790 level. By targeting the next resistance at

$3,842 6, the trade offers a highly favorable reward-to-risk ratio (2.78:1), aligning the tactical trade setup with professional risk management standards.1 - Consolidation Confirmation: The market is currently exhibiting high-level “sideways action or consolidation” near $3,800, which is recognized by technical experts as a “profound sign of strength” rather than a reversal warning.7 The limit order is designed to capture the price during this temporary supply absorption phase.

Retail Trader Engagement: Why This Signal is Popular

The XAU/USD Buy on Retracement signal is highly favored among retail traders due to strong psychological and structural influences:

- Belief in the Inevitable: The dominant market narrative is highly bullish, with forecasts of $4,000 being widely discussed as a certainty. This pervasive sentiment encourages retail traders to view every price drop as a temporary discount rather than a genuine reversal, promoting confidence in dip-buying.5

- Simple, Verifiable Technicals: The strategy relies on the clear, textbook concept of trading off a retested breakout level (S1 at $3,790).3 This provides a clean, objective reference point for setting both the entry and the stop-loss, simplifying trade execution for non-institutional traders.

- Structural Safety Net: Retail investors are aware that the gold rally is underpinned by powerful, long-term drivers that provide an inelastic floor:

- Central Bank Accumulation: Global central banks are aggressively buying gold, providing continuous, price-insensitive demand that absorbs significant selling pressure.8

- Monetary Policy Tailwinds: Expectations for U.S. Federal Reserve rate cuts are nearly certain (90% probability for October) 9, which reduces the opportunity cost of holding non-yielding gold and fuels inflows into the asset.

- Volatile Event Anticipation: Retail traders use Buy Limit orders in advance of major economic releases (like the ISM PMI and NFP later this week).1 If a negative data surprise triggers a sharp, short-term volatility spike, the limit order automatically activates at the desired support level, positioning the trader for the immediate reversal that usually follows the initial shock.9

Works cited

- Gold outlook: new highs for XAU/USD – FOREX.com, accessed on September 29, 2025, https://www.forex.com/en-us/news-and-analysis/gold-outlook-new-highs-for-xau-usd/

- XAU USD Technical Analysis – Investing.com, accessed on September 29, 2025, https://www.investing.com/currencies/xau-usd-technical

- Gold outlook: new highs for XAU/USD – FOREX.com, accessed on September 29, 2025, https://www.forex.com/en/news-and-analysis/gold-outlook-new-highs-for-xau-usd/

- Gold Stocks at Extreme Overbought Levels Signal High Risk of Sharp Correction, accessed on September 29, 2025, https://www.investing.com/analysis/gold-stocks-at-extreme-overbought-levels-signal-high-risk-of-sharp-correction-200667595

- Gold Spot / U.S. Dollar Trade Ideas — OANDA:XAUUSD – TradingView, accessed on September 29, 2025, https://www.tradingview.com/symbols/XAUUSD/ideas/

- Gold Analysis 29/09: Gold May Hold Gains (Chart) – Daily Forex, accessed on September 29, 2025, https://www.dailyforex.com/forex-technical-analysis/2025/09/gold-analysis-29-september-2025/234739

- Gold’s ‘Overbought’ Signal is a Trap, Here’s Why It’s Screaming Higher | Gary Wagner, accessed on September 29, 2025, https://www.youtube.com/watch?v=lIGCzTJ2itQ

- A new high? | Gold price predictions from J.P. Morgan Research, accessed on September 29, 2025, https://www.jpmorgan.com/insights/global-research/commodities/gold-prices

- XAUUSD Live: Key Gold Trading Insights for 2025 – ISA Bullion, accessed on September 29, 2025, https://www.isabullion.com/articles/xauusd-live-what-every-gold-trader-should-know-in-2025/

Prepared By Atik H. Rony

Leave a Reply